Delayed occupancy in a newly constructed home can be a frustrating experience for homeowners eagerly awaiting the completion of their property. Recognizing this, Tarion Warranty Corporation, Ontario's new home warranty provider, offers protection in the form of...

Elevate Your Outdoor Space – The Case for Custom Sheds Near You

Are you tired of stepping into your backyard and feeling underwhelmed by its appearance? Does the thought of updating your yard's landscaping and overall aesthetic linger in your mind? If so, you're not alone. Many homeowners find themselves in a similar situation,...

Planning a Fun and Safe Outdoor Birthday Party for Your 6-Year-Old with an Inflatable Obstacle Course

Are you preparing to celebrate your child's 6th birthday in mid-April? With the weather warming up and nature coming to life, an outdoor birthday party sounds like an excellent idea! If you're considering hosting a celebration that's both exciting and active, an...

Ensuring Food Safety – Installing a Commercial Exhaust Hood in Your London, Ontario Restaurant

Owning a restaurant in London, Ontario comes with its own set of challenges, especially when it comes to meeting health and safety regulations. Recently, your restaurant might have faced a setback during a health inspection due to a faulty exhaust hood. Now, you're...

Kitchen Renovations – Custom Cabinets vs. Professional Painting Services

Embarking on a kitchen renovation project can be an exciting yet daunting task. Among the myriad decisions you'll face, one of the most significant is what to do with your cabinets. Should you invest in new custom cabinets, or opt for a professional painting service...

Understanding Psychotherapy – What it Entails, Who Needs it, and How to Find a Therapist in Brantford, Ontario

In today's fast-paced and stressful world, mental health concerns have become increasingly prevalent. While many people recognize the importance of seeking professional help for their mental well-being, navigating the mental health landscape can be daunting. One key...

Transforming Your Vehicle: A Guide to Changing the Color with a Vehicle Wrap

Introduction Are you tired of your vehicle's current color? Looking for a fresh and exciting way to give your car a makeover? Vehicle wraps offer a creative and cost-effective solution to change the color of your vehicle without the need for a full paint job. In this...

Understanding Business Networking Events: Building Connections for Success

Introduction In today's fast-paced business world, networking has become an indispensable tool for professionals and entrepreneurs alike. Business networking events are a crucial part of this process, offering a platform for individuals to connect, collaborate, and...

Pros of an asphalt driveway

Paving a driveway with asphalt involves several steps to ensure a durable and smooth surface. Here is a general overview of the process: Initial Assessment: Before starting the project, you'll need to assess your driveway's condition and determine if it's suitable for...

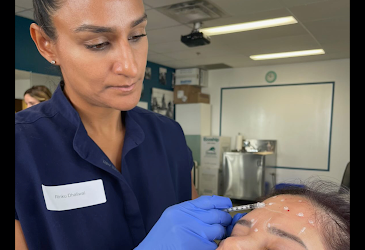

Should I Give Botox A Try?

Botox, a brand name for the drug botulinum toxin, is a popular cosmetic treatment used to temporarily reduce the appearance of wrinkles and fine lines. While it's essential to consult with a qualified medical professional before deciding on any cosmetic procedure,...

Exploring the Cost of Personal Training in Paris, Ontario: A Comprehensive Guide

Introduction If you're looking to embark on a fitness journey and achieve your health goals, enlisting the help of a personal trainer can be a game-changer. Personal training offers tailored workout plans, expert guidance, and accountability to help you maximize your...